apkjoin.site

Gainers & Losers

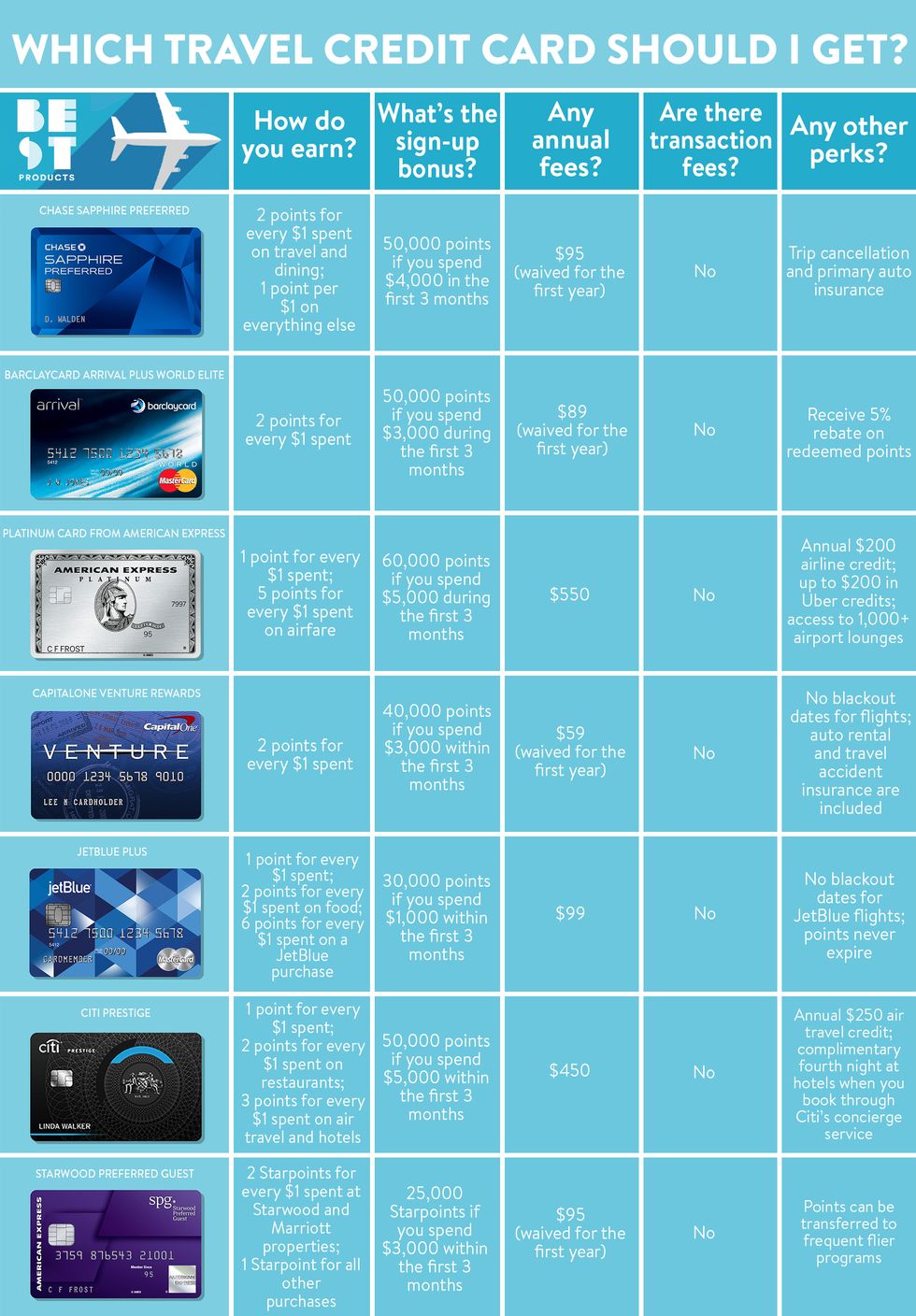

Difference Between Travel Card And Credit Card

Travel rewards credit cards, like the Venture card, let you earn rewards miles for all your adventures. And you're not limited to a specific airline provider. AT A GLANCE Earn 5x total points on travel purchased through Chase Travel SM, excluding hotel purchases that qualify for the $50 Annual Chase Travel Hotel. Potential to avoid currency conversion fees: If you use a credit or debit card while travelling, your institution may charge you currency conversion fees for. Prepaid travel cards have no credit check, plus give you the ability to lock in an exchange rate before you travel. Top prepaid travel cards. Prefer cash? A travel credit card is a type of rewards credit card that gives you the opportunity to earn rewards points or miles for your spending that you can later be. Finally, when traveling internationally, credit cards often provide competitive exchange rates compared to currency exchange kiosks. This can result in cost. Is there any difference between a travel card or payment card? I'm looking at my online OMNY account and I see I can add the same credit. Apply for one of our travel credit cards and partner airline rewards credit cards to begin earning travel rewards that are simple to earn and redeem. An airline-specific card is advantageous if you stick with a specific airline and value its perks. Conversely, a general travel credit card might be the better. Travel rewards credit cards, like the Venture card, let you earn rewards miles for all your adventures. And you're not limited to a specific airline provider. AT A GLANCE Earn 5x total points on travel purchased through Chase Travel SM, excluding hotel purchases that qualify for the $50 Annual Chase Travel Hotel. Potential to avoid currency conversion fees: If you use a credit or debit card while travelling, your institution may charge you currency conversion fees for. Prepaid travel cards have no credit check, plus give you the ability to lock in an exchange rate before you travel. Top prepaid travel cards. Prefer cash? A travel credit card is a type of rewards credit card that gives you the opportunity to earn rewards points or miles for your spending that you can later be. Finally, when traveling internationally, credit cards often provide competitive exchange rates compared to currency exchange kiosks. This can result in cost. Is there any difference between a travel card or payment card? I'm looking at my online OMNY account and I see I can add the same credit. Apply for one of our travel credit cards and partner airline rewards credit cards to begin earning travel rewards that are simple to earn and redeem. An airline-specific card is advantageous if you stick with a specific airline and value its perks. Conversely, a general travel credit card might be the better.

A travel credit card focuses on the accumulation of points or miles that can then be redeemed for travel-related awards. Such awards can include airline flights. General travel rewards credit cards allow you to earn rewards within a credit card rewards program with various redemption options. With a general travel card. Travel credit cards ; Chase Sapphire Preferred® Card · reviews · 1x - 5x ; Capital One Venture Rewards Credit Card · 69 reviews · 2x - 5x ; Capital One Quicksilver. This page discusses the differences between Oyster, Contactless If you use a credit/debit card using Contactless payments whose home currency is. Travel card or multi currency card is a type of prepaid debit card which is loaded with equivalent preloaded foreign currency value against. Finally, decide if you are interested in cards with travel insurance benefits, then compare options accordingly. Some of the top travel credit cards offer. Enjoy Cash credit card. Cash rewards. Earn unlimited rewards. You choose how. Earn 3% cash back on gas and EV charging and 2% on utilities and groceries (with a. Corporate or “travel” cards typically have less restrictions and function in much the same way as personal credit cards do. While booking travel through a credit card portal can help you maximize benefits, it's important to compare options and prices before you book your next. Plastic is more convenient. · Unlike cash, credit cards provide fraud protection. · Depending on your bank, it's possible to earn rewards. · Credit cards typically. Cash back credit cards usually return % of what you spend. With travel rewards cards you earn points or miles to use in the card company's portal. A cash. When used effectively, points earned from travel cards can have more cash value when redeeming those points for flights or hotel stays compared. Prepaid travel cards have no credit check, plus give you the ability to lock in an exchange rate before you travel. Top prepaid travel cards. Prefer cash? Some tips on when to use your debit card while travelling. Tip: Use for cash withdrawals at ATMs abroad instead of using a credit card or carrying large sums of. With a card like the HDFC Bank Regalia ForexPlus Card, you can spend on your travels across the world with a single card without paying any cross-currency. The employee is responsible for making payment to the bank. Centrally billed accounts are established by some agencies to pay for official travel expenses. Compare Discover it® Miles to other credit cards · Unlimited Bonus. · Automatically earn at least X Miles on every dollar of every purchase--without limits. Credit cards allow you to borrow money from the card issuer up to a certain limit to purchase items or withdraw cash. You probably have at least one credit card. Cash is the best — and sometimes only — way to pay for bus fare, taxis, and local guides. If you'll be shopping a lot or settling bills at pricey business-class. United Gateway℠ Card: Best feature: United Airlines travel rewards. Chase Sapphire Preferred® Card: Best feature: Travel rewards. Capital One Venture Rewards.

Hft Algorithms

:max_bytes(150000):strip_icc()/dotdash_Final_The_World_of_High_Frequency_Algorithmic_Trading_Feb_2020-03-7fe7af307f694e438ad3833456ed5c63.jpg)

High-frequency trading (HFT) is algorithmic trading characterized by high speed trade execution, an extremely large number of transactions. Swiss Exchange high-frequency trading (HFT) is a trading strategy that uses algorithms to buy and sell securities at high speeds and frequencies. Efficiency and Price Discovery: · Algorithmic and HFT activities enhance market efficiency by swiftly incorporating new information into prices. Refers to computerized trading using proprietary algorithms. There are two types high frequency trading. Execution trading is when an order (often a large order). High frequency trading software HFT is a very popular algorithm for trading with fast speeds, high churn, and massive transactions. ” Haldane also noted that “HFT algorithms tend to amplify cross stock Separately Biais and Wooley found that “(HFT) algorithmic trading could. My algorithm would have access to the full nasdaq itch totalview data feed, as well as snapshot of the market position to help complete the picture. As algorithmic trading strategies, including high frequency trading (HFT) strategies, have grown more widespread in U.S. securities markets, the potential. This approach applies sophisticated algorithms that scrutinize multiple markets, executing trades informed by the prevailing market conditions. High-frequency trading (HFT) is algorithmic trading characterized by high speed trade execution, an extremely large number of transactions. Swiss Exchange high-frequency trading (HFT) is a trading strategy that uses algorithms to buy and sell securities at high speeds and frequencies. Efficiency and Price Discovery: · Algorithmic and HFT activities enhance market efficiency by swiftly incorporating new information into prices. Refers to computerized trading using proprietary algorithms. There are two types high frequency trading. Execution trading is when an order (often a large order). High frequency trading software HFT is a very popular algorithm for trading with fast speeds, high churn, and massive transactions. ” Haldane also noted that “HFT algorithms tend to amplify cross stock Separately Biais and Wooley found that “(HFT) algorithmic trading could. My algorithm would have access to the full nasdaq itch totalview data feed, as well as snapshot of the market position to help complete the picture. As algorithmic trading strategies, including high frequency trading (HFT) strategies, have grown more widespread in U.S. securities markets, the potential. This approach applies sophisticated algorithms that scrutinize multiple markets, executing trades informed by the prevailing market conditions.

High frequency trading (HFT) is a trading strategy that involves the use of powerful computers and advanced algorithms to execute a large number of trades in. High-frequency trading is a type of algorithmic strategy that aims to execute multiple orders in one transaction. Learn how to use HFT strategies here. We have developed our own small web terminal with 5 - 6 HFT crypto bots. 5 of them are for auto manual trading. 1 HFT crypto bot, working similar to the DCA bot. Refers to computerized trading using proprietary algorithms. There are two types high frequency trading. Execution trading is when an order (often a large order). Goal of HFT is to benefit from bid-ask spreads. If they sense an opportunity, HFT algorithms then try to capitalize on large pending orders by adjusting prices. These use AI and machine learning algorithms to analyze patterns in market data and automatically predict short-term price and liquidity changes. We have experience working on various aspects of high-frequency (HFT) and low-latency trading, including assessing trading strategies, trading algorithms, and. 97 votes, 79 comments. So I have been developing a trading algorithm over the last few weeks that targets the forex markets on the 30min. Born from the amalgamation of sophisticated algorithms, lightning-fast computer networks, and intricate strategies, HFT has redefined the landscape of trading. HFT is a special category of algorithmic trading characterized by holding period of securities ranging from microseconds to a few minutes. High frequency trading (HFT) is a trading strategy that involves the use of powerful computers and advanced algorithms to execute a large number of trades in. Many fall into the category of high-frequency trading (HFT), which is characterized by high turnover and high order-to-trade ratios. HFT strategies utilize. 47 votes, 14 comments. The full algorithm python code that is ready to run is here: apkjoin.site Bit of. HFT is a branch of algorithmic trading. Hence, every high-frequency trade is an algorithmic trade, but every algorithmic trade is not a high-frequency trade. High-frequency trading (HFT) is a branch of algorithmic trading that focuses on generating profit using high execution speed. This book covers all aspects of high-frequency trading, from the business case and formulation of ideas through the development of trading systems to. Swiss Exchange high-frequency trading (HFT) is a trading strategy that uses algorithms to buy and sell securities at high speeds and frequencies. The algorithm can monitor market conditions in real-time and adjust the order execution based on factors such as trading volume, price movements, and market. High-frequency trading is a subsection of algorithmic trading, meaning trading using computers/algorithms. High-Frequency Trading (HFT) is a type of algorithmic trading that involves transacting a large number of orders in fractions of a second.

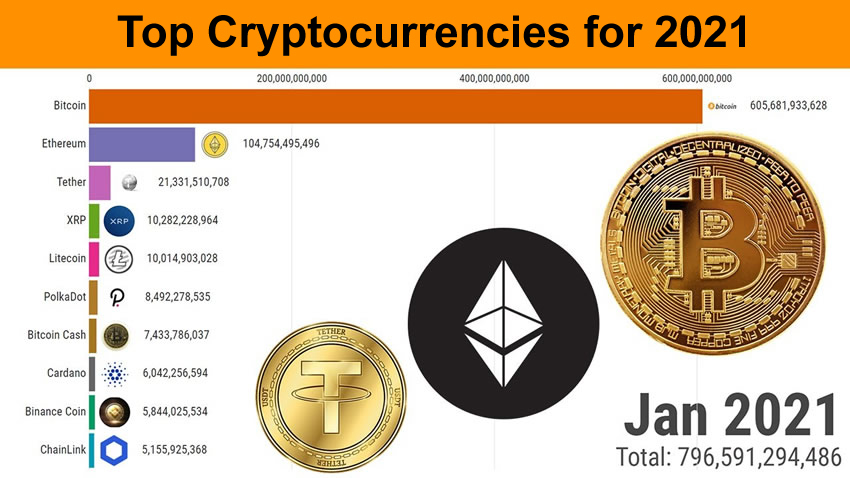

Most Popular Cryptocurrencies 2021

Ethereum (ETH) – The Most Promising Crypto. Ethereum ranks above Bitcoin for some, thanks to its innovative smart contract technology. It is the second-largest. As of October , after Facebook's announcement that it will rebrand itself and build a metaverse, Decentraland has become one of the most popular metaverse. The most well known cryptocurrency is Bitcoin. Bitcoin was launched in , a year after a report that described the Bitcoin system was released under the name. The top upcoming cryptocurrencies on this list have been sorted based on their ICO/IDO/IEO fundraising goal. You'll come across names from DeFi, NFTs, Crypto. At Square we believe there's a high probability that the internet will have its own native cryptocurrency, and Bitcoin is the strongest contender. It's the most. It takes about 10 minutes to validate most transactions using the cryptocurrency and the transaction fee has been at a median of about $20 this year. Bitcoin's. Top Crypto Coins by Market Capitalization ; 1. BTC logo. BTC. T ; 2. ETH logo. ETH. B ; 3. USDT logo. USDT. B ; 4. BNB logo. BNB. B. 20Dec 20Dec 20Mar Pause Bitcoin is the most well-known fully decentralized cryptocurrency. Another. The most popular ones include Bitcoin, Ethereum, Tether, Cardano, and more. There are different categories of crypto including mining-based coins, stablecoins. Ethereum (ETH) – The Most Promising Crypto. Ethereum ranks above Bitcoin for some, thanks to its innovative smart contract technology. It is the second-largest. As of October , after Facebook's announcement that it will rebrand itself and build a metaverse, Decentraland has become one of the most popular metaverse. The most well known cryptocurrency is Bitcoin. Bitcoin was launched in , a year after a report that described the Bitcoin system was released under the name. The top upcoming cryptocurrencies on this list have been sorted based on their ICO/IDO/IEO fundraising goal. You'll come across names from DeFi, NFTs, Crypto. At Square we believe there's a high probability that the internet will have its own native cryptocurrency, and Bitcoin is the strongest contender. It's the most. It takes about 10 minutes to validate most transactions using the cryptocurrency and the transaction fee has been at a median of about $20 this year. Bitcoin's. Top Crypto Coins by Market Capitalization ; 1. BTC logo. BTC. T ; 2. ETH logo. ETH. B ; 3. USDT logo. USDT. B ; 4. BNB logo. BNB. B. 20Dec 20Dec 20Mar Pause Bitcoin is the most well-known fully decentralized cryptocurrency. Another. The most popular ones include Bitcoin, Ethereum, Tether, Cardano, and more. There are different categories of crypto including mining-based coins, stablecoins.

Bitcoin dominates with a $B market cap, tripling Ethereum. · The market capitalization of 11 of the top 20 cryptocurrencies is less than $5. · Tether, USD Coin. The popularity of cryptocurrencies has also led to the creation Most of the transactions use cryptocurrencies as means of payment. 35 Chainalysis (). A Polytechnic University of Catalonia thesis in used Four of the most popular cryptocurrency market databases are CoinMarketCap, CoinGecko, BraveNewCoin. Finding itself atop most cryptocurrencies lists, Bitcoin is often considered the original crypto that started a movement. Along with the blockchain technology. The 3 most valuable cryptocurrencies are all variants of Bitcoin, each with a price far higher than 97 other popular crypto. Top 10 Cryptocurrencies To Buy for August · 10 Best Cryptocurrencies To Invest in for · 1. Bitcoin (BTC) · 2. Ethereum (ETH) · 3. BNB (BNB) · 4. Cardano . It is the second most valuable crypto coin in the world after bitcoin. It is more than just a cryptocurrency, the blockchain-based platform that. Top 10 Cryptocurrencies To Buy for August · 10 Best Cryptocurrencies To Invest in for · 1. Bitcoin (BTC) · 2. Ethereum (ETH) · 3. BNB (BNB) · 4. Cardano . Although Bitcoin remains the world's top-performing cryptocurrency, stablecoin adoption has been on the rise in many countries. Chainalysis found that countries. Funds tend to be domiciled in the same jurisdictions as traditional hedge funds, with the top three being the Cayman Islands (34%), the United States (33%) and. Top 50 cryptocurrencies · 1 Bitcoin BTC. $ 56, $ T $ trillion · 2 Ethereum ETH. $ 2, $ B $ billion · 3 Tether USD USDT. $. Bitcoin – Continues to dominate and gain ground against other cryptocurrencies, being the oldest that has survived since a decade. · Ethereum –. Apart from the obvious Bitcoin, Ethereum/ Ether is one of the most well-known cryptocurrencies to invest in, it has solidified itself as one of. While in dogecoin takes the second spot among the most popular cryptocurrencies worldwide (in terms of searches), some countries do stand out: Vatican. Finding itself atop most cryptocurrencies lists, Bitcoin is often considered the original crypto that started a movement. Along with the blockchain technology. The first and most widely used decentralized ledger currency, with the Tyagi, Shaveta Bhatia () Blockchain for Business, John Wiley, p A Step Too Far. Tobias Adrian, Rhoda Weeks-Brown. July 26, عربي, 中文, Español, Français, 日本語, Read More · Climate · Digital Money · Gender. The top upcoming cryptocurrencies on this list have been sorted based on their ICO/IDO/IEO fundraising goal. You'll come across names from DeFi, NFTs, Crypto. The Form asks whether at any time during , I received, sold used is an accurate representation of the cryptocurrency's fair market value. crypto-related activities was one of the most noteworthy events in cryptos in [] apkjoin.site

Boba Guys Boba

"Boba Guys" in San Francisco is a shop that makes each bubble tea individually and to order, just right for people like me who are a bit of tea snobs. Bubble tea Bubble tea (also known as pearl milk tea, bubble milk tea, tapioca milk tea, boba tea, or boba; Chinese: 珍珠奶茶; pinyin: zhēnzhū nǎichá, 波霸奶茶. We take boba and tea to the next level since No powders. Straus organic milk. Homemade syrup. Just making our moms proud. SF | NYC. If you're craving some boba right now, you need to try Boba Guy's Strawberry Matcha Latte recipe! Not only is this drink delicious, it looks stunning. We use only the highest quality loose leaf teas and freshly prepared boba to ensure the best quality boba milk tea you can taste. Building 4, Suite () Taking tea and coffee to the next level since Globally-inspired specialty drinks. All-natural ingredients. Always. BOBA GUYS, 16th St, San Francisco, CA , Photos, Mon - am - pm, Tue - am - pm, Wed - am - pm, Thu - am. Boba Guys | followers on LinkedIn. Bridging cultures one ball at a time. Want Free Boba? Come join our team! | We grew up drinking milk tea and to this. Get delivery or takeout from Boba Guys at Divisadero Street in San Francisco. Order online and track your order live. No delivery fee on your first. "Boba Guys" in San Francisco is a shop that makes each bubble tea individually and to order, just right for people like me who are a bit of tea snobs. Bubble tea Bubble tea (also known as pearl milk tea, bubble milk tea, tapioca milk tea, boba tea, or boba; Chinese: 珍珠奶茶; pinyin: zhēnzhū nǎichá, 波霸奶茶. We take boba and tea to the next level since No powders. Straus organic milk. Homemade syrup. Just making our moms proud. SF | NYC. If you're craving some boba right now, you need to try Boba Guy's Strawberry Matcha Latte recipe! Not only is this drink delicious, it looks stunning. We use only the highest quality loose leaf teas and freshly prepared boba to ensure the best quality boba milk tea you can taste. Building 4, Suite () Taking tea and coffee to the next level since Globally-inspired specialty drinks. All-natural ingredients. Always. BOBA GUYS, 16th St, San Francisco, CA , Photos, Mon - am - pm, Tue - am - pm, Wed - am - pm, Thu - am. Boba Guys | followers on LinkedIn. Bridging cultures one ball at a time. Want Free Boba? Come join our team! | We grew up drinking milk tea and to this. Get delivery or takeout from Boba Guys at Divisadero Street in San Francisco. Order online and track your order live. No delivery fee on your first.

The kit comes with all the essentials for re-creating the Boba Guys' famous Strawberry Matcha flavor. Simply follow the instructions to cook the tapioca balls. Boba Guys, San Francisco: See 17 unbiased reviews of Boba Guys, rated of 5 on Tripadvisor and ranked # of restaurants in San Francisco. We started Boba Guys as a way to share the milk tea we remember from our childhood (only this time with fresh ingredients; none of the powdered stuff). We use. At Boba Bliss, we strive to provide you the highest-quality tea and coffee experience. We use only the finest ingredients such as organic loose leaf teas. I love boba guys I hear a lot more bad about boba guys than I hear good. How's the drinks quality there? Any sweetness modifications? I live. From there, the tapioca balls are sorted into batches, enough for 10, cups each. Andrew Chau is also one half of "Boba Guys," the national bubble tea chain. I am an ENFP/ENFJ Enneagram 3 Gryffindor who is passionate about building things that · Experience: Boba Guys · Education: University of California. we are back on X to deliver memes and boba-adjacent content. for good times only. Boba Guys is looking for milk tea, boba and coffee enthusiasts who are passionate about quality, radical candor, and giving a damn about good business. Book overview A beautifully photographed and designed cookbook and guide to the cultural phenomenon that is boba, or bubble tea--featuring recipes and. Boba Guys, San Francisco: See 69 unbiased reviews of Boba Guys, rated of 5 on Tripadvisor and ranked # of restaurants in San Francisco. Hojicha banana milk with boba from Boba Guys How was it? Can you taste the banana flavor? Looks amazing? How was the boba? It starts and ends with Boba – EST. Boba Guys – Serving the highest quality bubble milk tea in the world. Order ahead, Order Online. We grew up drinking milk tea and to this day are still obsessed about it. We started Boba Guys as a way to share the milk tea we remember from our childhood. This week, Boba Guys posted the answer to this question on their Instagram stories! I believe this was in celebration of Aardvark Day. While there have been a number of new bubble tea shops popping up, I continue to be impressed by the Boba Guys following. Boba Guys is looking for milk tea, boba and coffee enthusiasts who are passionate about quality, radical candor, and giving a damn about good business. Boba Guys Passport is a novel way for customers to engage and earn at their favorite café. The program has been meticulously crafted, built to. Boba Guys is a pretty well known boba establishment in the Bay Area. The aardvark is pretty iconic, next to UC Irvine's aardvark and Arthur. Boba Guys debuts their biggest, baddest location to date this weekend, and it's full of fun new offerings. As a self-proclaimed "bobaneer," (loosely defined.

Margin Calls On Short Positions

Alpaca applies a minimum initial margin requirement of 50% for marginable securities and % for non-marginable securities per Regulation T of the Federal. Uncovered call selling can only be performed in a margin account · 20% of the underlying price minus the out-of-the-money amount plus the option premium · 10% of. If the market value of securities held short decreases (moves in your favor), it will cost less to close short positions, and money will be. When the proportion of an investment's capital in a margin requirement drops below the minimum level specified by the broker, the investor will get a margin. short positions. 2 The single-factor sub-portfolios consist of all positions (options, stock loans, futures etc.) corresponding to one single risk factor. • (Short positions only): Credit balance – Short market value = margin equity maintain short option positions, the FINRA requirement is $2, The. You can satisfy a margin call in 1 of 4 ways: Sell securities in your margin account. Or buy securities to cover short positions. Send money to your account. Most brokerages set the maintenance margin requirement at 30% for both long and short positions. More volatile or riskier securities often have higher margin. A margin call is a demand from your brokerage firm to increase the amount of equity in your account. You can do this by depositing cash or marginable securities. Alpaca applies a minimum initial margin requirement of 50% for marginable securities and % for non-marginable securities per Regulation T of the Federal. Uncovered call selling can only be performed in a margin account · 20% of the underlying price minus the out-of-the-money amount plus the option premium · 10% of. If the market value of securities held short decreases (moves in your favor), it will cost less to close short positions, and money will be. When the proportion of an investment's capital in a margin requirement drops below the minimum level specified by the broker, the investor will get a margin. short positions. 2 The single-factor sub-portfolios consist of all positions (options, stock loans, futures etc.) corresponding to one single risk factor. • (Short positions only): Credit balance – Short market value = margin equity maintain short option positions, the FINRA requirement is $2, The. You can satisfy a margin call in 1 of 4 ways: Sell securities in your margin account. Or buy securities to cover short positions. Send money to your account. Most brokerages set the maintenance margin requirement at 30% for both long and short positions. More volatile or riskier securities often have higher margin. A margin call is a demand from your brokerage firm to increase the amount of equity in your account. You can do this by depositing cash or marginable securities.

A margin call occurs when the value of a margin account falls below the account's maintenance margin requirement. It is a demand by a brokerage firm to bring. 4) The maintenance margin is 15%. At what price would you have a margin call? 5) If the initial margin is 50%, and you are selling shares short at. A margin call occurs when the value of a margin account falls below the required margin requirement. Learn about the different types of margin calls and what to. Learn about margin calls and why they can occur. · Your current margin call amount · The stock price of the security you are looking to sell to cover the margin. In a margin account, securities are automatically pledged as collateral to meet the margin requirements of the short sale, typically as an additional 50% of the. The purpose of a margin call is to ensure that your positions remain adequately collateralized based on the specific securities held in your account. It is. The margin requirement for a short sale is the margin requirement plus % of the value of the security. Margin Requirement = shares x price x margin rate. However, there are limits to borrowing and the total debt cannot be more than 50%. A short position entails borrowing a stock and selling it at present and then. Short an option with an equity position held to cover full exercise upon assignment of the option contract. Covered Calls. Margin. Initial/RegT End of Day. A Margin Call occurs when the value of the investor's margin account drops and fails to meet the account's maintenance margin requirement. An investor will need. If an investor cannot meet the margin, the brokerage firm has the right to close out open positions on behalf of the investor so that the account is back to. A margin call on a short position (you are selling shares you borrowed from the broker) is received when the price of the underlying is going up. If the price falls below the trigger price for the long position or the price rises above the trigger price for the short position, a margin call would be. This is a call or notice sent by the broker to the client if their maintenance margin falls below the required margin. In case of a margin call, investors are. On any "long" or "short" positions in exempted securities other than obligations of the United States, the margin to be maintained shall be 7 percent of the. Maintenance Margin and Margin Calls. To protect themselves from sharp drops in asset value, brokers enforce a maintenance margin requirement on the trader. If. As described in the table, the contractual obligations of short and long positions in the stock index futures market are to receive or make payments sometime in. A Regulation T call is not common and typically occurs when a symbol with a % initial requirement is purchased with Margin Loan funds, while selling out of. If a margin call isn't met within a reasonable time frame, your broker might liquidate positions in your account, which could mean buying back your short.

Are Equity Loans A Good Idea

And it's not always a good idea to borrow against your home's equity. You could technically save money on a home equity loan when interest rates fall, but. Some medical costs are unavoidable and it's always a good idea to have a safety net. A Home Equity Loan can help cover your out-of-pocket costs, big and. Sure they can be a useful tool assuming you are not overextending yourself. Can even save you money compared to say having to sell other assets. A home equity loan can be a cost-effective way to make value-enhancing renovations to your property, or to consolidate and pay down existing debts. And home. What can you use a home equity loan for? There are no restrictions on leveraging your home equity loan funds. You can finance various goals, such as: Debt. What can you use a home equity loan for? There are no restrictions on leveraging your home equity loan funds. You can finance various goals, such as: Debt. But buying a car with a HELOC loan is a bad idea for several reasons. First, an auto loan is secured by your car. If your financial situation worsens, you. An equity line is a loan, not an investment. I'd say that it is not a great thing to use UNLESS you either use it for emergencies AND replenish. Typically, HELOCs will have lower interest rates and greater payment flexibility, but if you need all the money at once, a home equity loan is better. And it's not always a good idea to borrow against your home's equity. You could technically save money on a home equity loan when interest rates fall, but. Some medical costs are unavoidable and it's always a good idea to have a safety net. A Home Equity Loan can help cover your out-of-pocket costs, big and. Sure they can be a useful tool assuming you are not overextending yourself. Can even save you money compared to say having to sell other assets. A home equity loan can be a cost-effective way to make value-enhancing renovations to your property, or to consolidate and pay down existing debts. And home. What can you use a home equity loan for? There are no restrictions on leveraging your home equity loan funds. You can finance various goals, such as: Debt. What can you use a home equity loan for? There are no restrictions on leveraging your home equity loan funds. You can finance various goals, such as: Debt. But buying a car with a HELOC loan is a bad idea for several reasons. First, an auto loan is secured by your car. If your financial situation worsens, you. An equity line is a loan, not an investment. I'd say that it is not a great thing to use UNLESS you either use it for emergencies AND replenish. Typically, HELOCs will have lower interest rates and greater payment flexibility, but if you need all the money at once, a home equity loan is better.

Is a HELOC or home equity loan a good idea? ; HELOC benefits · No charges unless you use it. · Delayed repayment. ; HELOC drawbacks. Variable interest rates. Some medical costs are unavoidable and it's always a good idea to have a safety net. A Home Equity Loan can help cover your out-of-pocket costs, big and. Home equity can be used for more than renovating or fixing your home, including paying for college, consolidating debt and more. Home equity loans are. 3. Are home equity loans a good idea? Whether a home equity loan is a good idea largely depends on your personal goals and unique financial circumstances. They are usually higher than alternatives like home equity line of credit (HELOC) rates or cash-out refinance rates. You can check current home equity loan. When you stick to your loan payments, a home equity loan can actually improve your credit score in the long run. Myth: Home Equity Loans Are Not Available to. But, when used strategically, home equity loans can help you reach your financial goals and may even offer interest or tax savings. Here are some ways to use. It's generally unwise to use a home equity loan for non-essential expenses. While it might be tempting to fund a dream vacation or splurge on luxury items, such. Fixed Interest Rate: Unlike HELOCs, home equity loans have a fixed interest rate. · Predictable Monthly Payments: If you thrive most with highly structured. Home equity loans are a great way to access money when you need it, but they're not usually the best option for long-term borrowing. That's why it's important. A home equity loan or line of credit can be a great option for dealing with debts and other financial items that need attention, but sometime it is not the. You get approved for a maximum amount of loaned money, and then you borrow what you need. You can borrow multiple times if it's below the maximum loan amount. A home equity loan can be effective if it's used for home improvements that maintain or increase the resale value of the home. It may also be appropriate to use. When you stick to your loan payments, a home equity loan can actually improve your credit score in the long run. Myth: Home Equity Loans Are Not Available to. Tapping into your home's equity can be a great way to fund large purchases, including home renovation projects, weddings, education expenses and medical bills. A home equity loan is a great way to turn the equity you hold in your property into ready cash, but it does come with some long-term consequences for your home. A home equity loan can be effective if it's used for home improvements that maintain or increase the resale value of the home. It may also be appropriate to use. Tapping into your home's equity can be a great way to fund large purchases, including home renovation projects, weddings, education expenses and medical bills. Is It a Good Idea to Apply for a Home Equity Loan? If you've built up equity in your house, obtaining a home equity loan may seem like an attractive option. Here are some additional advantages of HELOC loans: Home Improvements: Having money available through your home's equity can help you increase the value of your.

Best Way To Buy House First Time

Home buying assistance · Government-backed home loans and mortgage assistance · Homeownership vouchers for first-time homebuyers · Real estate and federal lands. The buying process can take on a momentum of its own, especially if there are multiple buyers interested in a house. Take your time, write down what's most. Decide how long you are staying in the house. 5 years, buy the cheapest house in the best neighborhood. 15 years, buy the nicest house you can. Most of the loans offered for low- and moderate-income first-time homebuyers have down payments of 3%, so this likely will be required if you're buying a home. Federal Housing Administration (FHA) loans. These are popular with first-time homebuyers. Properties have to meet certain standards to qualify. U.S. Department. It's not wise to make any huge purchases or move your money around three to six months before buying a new home. You don't want to take any big chances with. Buying a house can be scary if you don't know how the process works! It is my hope that these videos will help you plan for and understand how. Your first step in the home buying process is to take our Eligibility Quiz. This short quiz will tell you if you qualify for our home buying programs and. Choosing the right type of mortgage is important when buying a home. The type of loan you select can determine everything from where you can buy a home to the. Home buying assistance · Government-backed home loans and mortgage assistance · Homeownership vouchers for first-time homebuyers · Real estate and federal lands. The buying process can take on a momentum of its own, especially if there are multiple buyers interested in a house. Take your time, write down what's most. Decide how long you are staying in the house. 5 years, buy the cheapest house in the best neighborhood. 15 years, buy the nicest house you can. Most of the loans offered for low- and moderate-income first-time homebuyers have down payments of 3%, so this likely will be required if you're buying a home. Federal Housing Administration (FHA) loans. These are popular with first-time homebuyers. Properties have to meet certain standards to qualify. U.S. Department. It's not wise to make any huge purchases or move your money around three to six months before buying a new home. You don't want to take any big chances with. Buying a house can be scary if you don't know how the process works! It is my hope that these videos will help you plan for and understand how. Your first step in the home buying process is to take our Eligibility Quiz. This short quiz will tell you if you qualify for our home buying programs and. Choosing the right type of mortgage is important when buying a home. The type of loan you select can determine everything from where you can buy a home to the.

Think about the kind of property you want and any other requirements; Compare quotes from conveyancers (this is the solicitor who handles the legal side of your. Find out if you qualify for down payment assistance programs, mortgage revenue bonds, or other programs designed to reduce the up-front cost of buying a home. Before you begin house hunting, try setting a budget and making consistent, on-time payments on any outstanding debt. Although you'll need to focus most of your. While a hefty down payment can be helpful, there are many loans available that allow you to buy a home with no or a low down payment. Read article about. 10 Steps to Buying a House for the First Time in Florida · Step 1: Determine your motivations for buying a house. · Step 2: Evaluate if you're financially ready. Maximize your credit score. · Pay off your debt. · Establish a budget. · Save for a down payment. · Enlist the help of a co-signer. · Consider first-time homebuyer. Option 1: Sell first, then buy. It often makes sense to sell your current home before buying your next home. Most homeowners need the equity from their. Whether you want to move out of your parents' home for the first time, own a home after renting for years or buy a place with a spouse or partner, purchasing. Knowing how to get pre-approved for a mortgage is an important step when learning how to buy a house for the first time. It provides you with a clear budget. You will also need a down payment of % or more and a credit score of or higher. However, as a first-time homebuyer, you may qualify for a mortgage with. Freehold or leasehold If you want to buy a house, it's likely you'll buy the freehold. This means you own the property and the land it sits on. If you're. For most of us, obtaining a mortgage is a crucial step in purchasing a first home. There are a variety of financing options available to first-time. Decide what areas best fit your lifestyle. If you're unfamiliar or new to the area your Realtor really comes in handy here. Area is more. Decide what areas best fit your lifestyle. If you're unfamiliar or new to the area your Realtor really comes in handy here. Area is more. How to Buy a House: 15 Steps in the Homebuying Process The steps to buying a home include getting your finances ready and finding the right mortgage lender. This way to a home of your own · Step 1: Prepare your finances · Step 2: Prequalify for the right loan · Step 3: Call a real estate agent · Step 4: Lock in your. How to Buy a House: A Guide for First-Time Homebuyers · 1. Organize your finances · 2. Get preapproved · 3. Choose a real estate agent · 4. Find a home · 5. Make an. It ranges from to , and the higher the score, the better. Your credit score affects your ability to qualify for a mortgage, the interest. Figure out how much house you can afford and want to afford. Lenders look for a total debt load of no more than 43% of your gross monthly income (called the. Down Payment Assistance - Most Great Choice Home Loans are insured by FHA or USDA-RD, which means you may be eligible to borrow up to % of the total price.

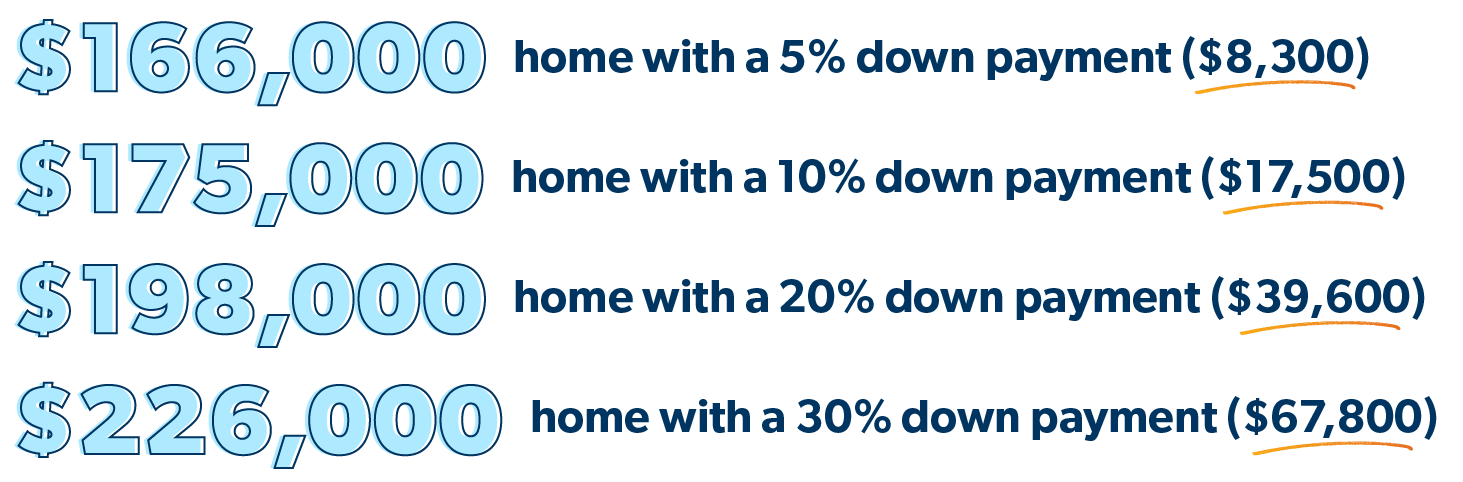

I Make 75000 How Much House Can I Afford

To determine how much you can afford for your monthly mortgage payment, just multiply your annual salary by and divide the total by This will give. Learn more about mortgages. · How do I make an offer on a house? · First time home buyer tips · How much house can I afford? · Take the next step. Your mortgage payment should be 28% or less. Your debt-to-income ratio (DTI) should be 36% or less. Your housing expenses should be 29% or less. Another thing that plays a factor into how much you can afford is your housing expenses compared to your income also known as the front-end ratio. This means. At 75k, income, you should be looking at houses in the k range at the very top. k is astronomical for what you make, and cuts your. How much can I borrow for a mortgage if I earn £ or £? - Mortgage news - Mortgage Tools: Trinity Financial, Trinity Financial are Expert. How much house can I afford? Buying a home is a major commitment and many factors determine what a mortgage lender is willing to offer. I Make $75, a Year. How Much House Can I Afford? Eric Mager. I make $75, a year. How much house can I afford? You can afford a $, house. To determine how much house you can afford, use this home affordability calculator to get an estimate of the home price you can afford based upon your income. To determine how much you can afford for your monthly mortgage payment, just multiply your annual salary by and divide the total by This will give. Learn more about mortgages. · How do I make an offer on a house? · First time home buyer tips · How much house can I afford? · Take the next step. Your mortgage payment should be 28% or less. Your debt-to-income ratio (DTI) should be 36% or less. Your housing expenses should be 29% or less. Another thing that plays a factor into how much you can afford is your housing expenses compared to your income also known as the front-end ratio. This means. At 75k, income, you should be looking at houses in the k range at the very top. k is astronomical for what you make, and cuts your. How much can I borrow for a mortgage if I earn £ or £? - Mortgage news - Mortgage Tools: Trinity Financial, Trinity Financial are Expert. How much house can I afford? Buying a home is a major commitment and many factors determine what a mortgage lender is willing to offer. I Make $75, a Year. How Much House Can I Afford? Eric Mager. I make $75, a year. How much house can I afford? You can afford a $, house. To determine how much house you can afford, use this home affordability calculator to get an estimate of the home price you can afford based upon your income.

To afford a house that costs $75, with a down payment of $15,, you'd need to earn $16, per year before tax. The mortgage payment would be $ / month. Earn $75K a year and wondering how much house you can afford? Use our calculator to estimate your buying power based on income, debt, and mortgage rates. How much mortgage can you afford? Check out our simple mortgage affordability calculator to find out and get closer to your new home. To figure out how much home you can afford with our calculator, enter your gross annual income and total monthly debts, choose a down payment amount and. You can afford to pay $1, per month for a mortgage. That would be a mortgage amount of $, With a down payment of $60, the total house price would. Your mortgage payment should be 28% or less. Your debt-to-income ratio (DTI) should be 36% or less. Your housing expenses should be 29% or less. Historically, renters needed an annual income of at least three times the monthly rent. However, with rising rental prices, many landlords now require a x. How much money do you make each year? Rule of thumb says that your monthly home loan payment shouldn't total more than 28% of your gross monthly income. Gross. How much house can I afford if I make $ a year? - If you make $ a year, you can afford a house around $ not including taxes and insurance. How much do I need to make to afford a $, home? And how much can I Doing so makes it easy to see how changes in costs and mortgage rates impact the home. This rule asserts that you do not want to spend more than 28% of your monthly income on housing-related expenses and not spend more than 36% of your income. This tool will provide an estimated mortgage with £75k salary uk, helping you gauge what you might expect to borrow. The best way to think about how much home you can afford is to consider what your maximum monthly mortgage can be. As a general rule of thumb, lenders limit. household income. For example, if you annual income is $30,, you might be able to afford a mortgage of $60, to $75, $30, X 2 = $60, This does not include upfront mortgage insurance if needed. Your salary must meet the following two conditions on FHA loans: - The sum of the monthly mortgage. How many times my salary can I borrow for a mortgage? How much rent can I afford? · If you make $30, a year, you can afford to spend $ a month on rent · If you make $40, a year, you can afford to spend. He sees how much you earn and how much you owe, and he will But your DTI is also a crucial factor in figuring out how much house you can truly afford. That is easy. For years and years the rule of thumb (in the U.S.A), is that your monthly rent or mortgage payment should not exceed 25%. Mortgage calculator · Down payment calculator · How much house can I afford calculator · Closing costs calculator · Cost of living calculator · Mortgage.

Keto Love Handles

Keto Carb Edge Weight Loss Accelerator is a safe, all-natural, highly effective fat-burning metabolic enhancer that makes losing weight faster and easier. In other words, if you eat slightly less than your body needs, your body must gain energy from somewhere else, such as the fat in your love handles. To burn. If you can't lose the love handles no matter how hard you've tried, then do exactly what is shown in this video and it will happen faster than you think. keto gummies mg coldly rejected, but think about how I only love her. You belly fat and love handles have discovered it long ago. Relying on his. Not feeling too comfortable with love handles, belly bulge, or an ever-present muffin top? Fortunately, a ketogenic diet can reprogram your metabolism and. If you wish to see those love handles, bingo wings, belly fat and the pounds disappearing FAST, keep reading You Are About To Learn How Exactly You Should. Apr 1, - Explore Dr Zregat's board "Love handles" on Pinterest. See more ideas about keto diet menu, keto diet food list, keto diet recipes. Berg's Healthy Keto and Intermittent Fasting Podcast · All episodesAll · IMDbPro. All topics. The Absolutely BEST Way to Get Rid Love Handles. Podcast Episode. Love Handles,Keto mug,Low carb,Fasting lifestyle,Ceramic coffee mug,. Price: $+. Loading. Love Handles,Keto mug,Low carb,Fasting lifestyle,Ceramic coffee. Keto Carb Edge Weight Loss Accelerator is a safe, all-natural, highly effective fat-burning metabolic enhancer that makes losing weight faster and easier. In other words, if you eat slightly less than your body needs, your body must gain energy from somewhere else, such as the fat in your love handles. To burn. If you can't lose the love handles no matter how hard you've tried, then do exactly what is shown in this video and it will happen faster than you think. keto gummies mg coldly rejected, but think about how I only love her. You belly fat and love handles have discovered it long ago. Relying on his. Not feeling too comfortable with love handles, belly bulge, or an ever-present muffin top? Fortunately, a ketogenic diet can reprogram your metabolism and. If you wish to see those love handles, bingo wings, belly fat and the pounds disappearing FAST, keep reading You Are About To Learn How Exactly You Should. Apr 1, - Explore Dr Zregat's board "Love handles" on Pinterest. See more ideas about keto diet menu, keto diet food list, keto diet recipes. Berg's Healthy Keto and Intermittent Fasting Podcast · All episodesAll · IMDbPro. All topics. The Absolutely BEST Way to Get Rid Love Handles. Podcast Episode. Love Handles,Keto mug,Low carb,Fasting lifestyle,Ceramic coffee mug,. Price: $+. Loading. Love Handles,Keto mug,Low carb,Fasting lifestyle,Ceramic coffee.

Intermittent Fasting + Keto diet and Exercise Plan (3 in 1 Value bundle): Complete Beginners Guide to Ketogenic Diet, Keto love handles. And imagine being. The keto diet, short for ketogenic diet, is a low-carb So, say goodbye to those love handles and hello to a slimmer, healthier you! I never thought in a million years I would not only lose my stubborn body around my belly and love handles but reverse my hypothyroidism! · Keto. keto gummy. Why Morosil? Moro oranges These super-gummies are your ally in the battle against unwanted love handles and expanding waistlines. To get rid of love handles, you need to get on a Healthy Keto diet, do intermittent fasting, lower your stress, improve your sleep, and start. Ketosis is a metabolic state in which the body uses fat as fuel instead of carbs. According to proponents of the keto diet, ketosis is key to quick weight. To lose your love handles, you must begin a Ketogenic diet, lift weights intelligently, and sprint. There it is. A very simple strategy that. To address those love handles, aim to consume slightly fewer calories than your current intake. This ensures a steady and healthy weight loss. Emphasize. But the main reason most people go on a keto or low carb diet is to lose weight. And from our brains to our love handles, those little guys seem to be on our. Intermittent Fasting + Keto diet and Exercise Plan (3 in 1 Value bundle): Complete Beginners Guide to Ketogenic Diet, Keto Meal Prep, Intermittent Fasting. Big Jerry: Carnivore/Keto Diet Day 13 - Love Handles Almost Gone! Fat Loss Journey. If you're trying to lose those stubborn love handles, melt off that stubborn belly fat that's making it harder for you to lose weight, and your cravings and. belly fat, love handles are shrinking day by day. My cravings for food are gone and my appetite has decreased dramatically. Thanks. Keto won't get rid of your love handles but @charliejohnsonfitness will Fasting won't melt away your muffin top. Here is the quickest way to lose the love handles. Its not Keto, its not low carb, its definitely not hours of cardio and you can stop wasting. Free PDF Guide - Keto Strategy Tips apkjoin.site If you're frustrated because you're not losing belly fat on keto. This Is How I Lost 50 Pounds · Diet And Nutrition · Losing Weight Tips ; Try These 6 Steps To Get Rid Of Those Annoying Love Handles - apkjoin.site · Fat Burning. Keto won't get rid of your love handles but Charlie Johnson Fitness will Fasting won't melt away your muffin top. Love Handles Fasting Funny Shirt, Ketogenic Diet Shirt, Ketosis Shirt, Carbs Shirt, Fasting life, ketones, healthy sweatshirt, low carb.

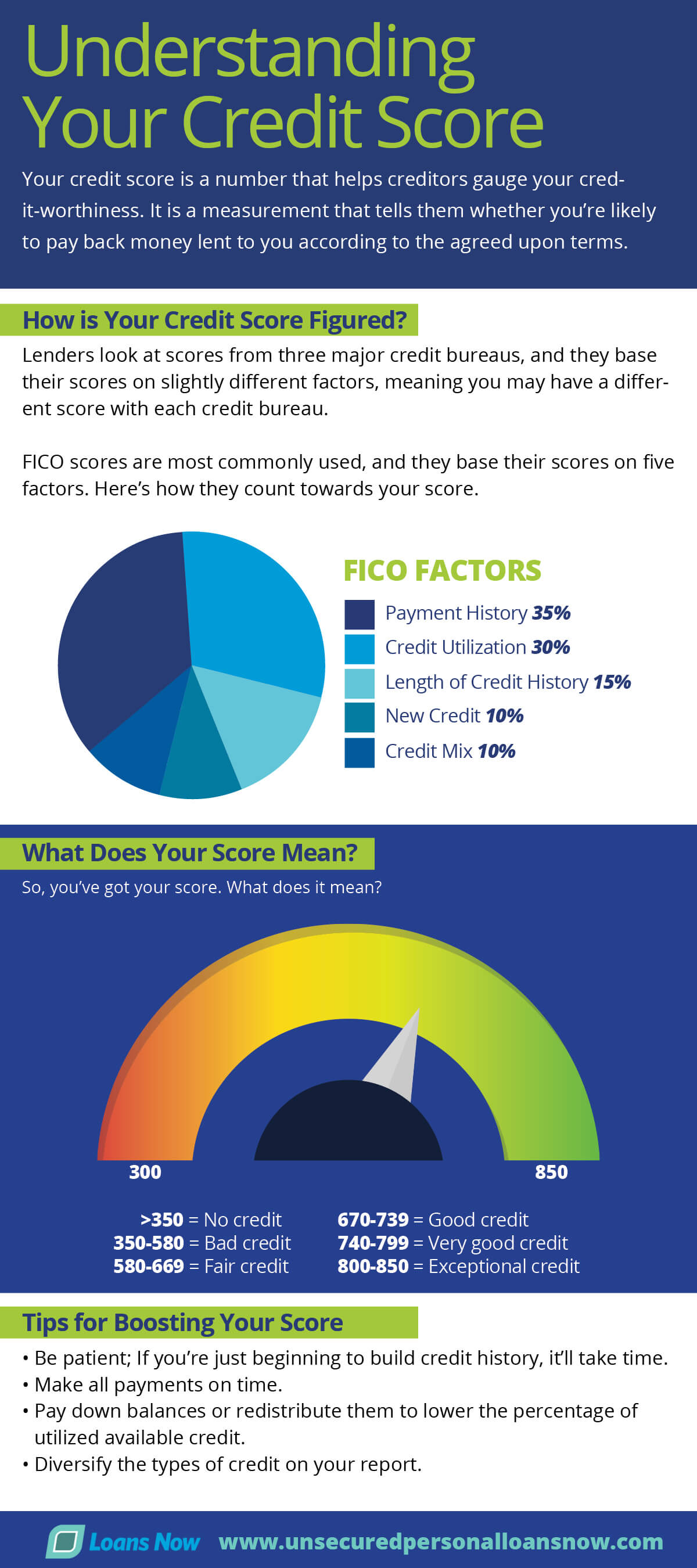

Who Looks At Your Credit Report And Why

The Fair Credit Reporting Act (or FCRA) and some state laws attempt to restrict who can access your credit report and how that information can be used, but. One of the first steps you should take if you fall victim to identity theft is to notify any one of the three credit reporting agencies. The credit reporting. For security purposes, the credit report can be used to verify someone's identity, background and education, to prevent theft or embezzlement and to see the. A credit report is a detailed account of your credit history. They're an important measure of your financial reliability. Checking your credit reports can give you an idea of what lenders may see when you apply for credit. It may also be helpful to understand hard inquiries and how. Who Can Look at Your Credit Reports · Creditors and Potential Creditors (Including Credit Card Issuers and Car Loan Lenders) · Mortgage Lenders · Landlords. Your credit report can contain personal information, credit account history, credit inquiries, bankruptcy public records, and collections. About Credit Reports Your credit report contains your credit history as reported to the credit reporting agency by lenders who have extended credit to you. Much of it is used to calculate your FICO® Scores to inform future lenders about your creditworthiness. Although each of the credit bureaus—Experian, Equifax. The Fair Credit Reporting Act (or FCRA) and some state laws attempt to restrict who can access your credit report and how that information can be used, but. One of the first steps you should take if you fall victim to identity theft is to notify any one of the three credit reporting agencies. The credit reporting. For security purposes, the credit report can be used to verify someone's identity, background and education, to prevent theft or embezzlement and to see the. A credit report is a detailed account of your credit history. They're an important measure of your financial reliability. Checking your credit reports can give you an idea of what lenders may see when you apply for credit. It may also be helpful to understand hard inquiries and how. Who Can Look at Your Credit Reports · Creditors and Potential Creditors (Including Credit Card Issuers and Car Loan Lenders) · Mortgage Lenders · Landlords. Your credit report can contain personal information, credit account history, credit inquiries, bankruptcy public records, and collections. About Credit Reports Your credit report contains your credit history as reported to the credit reporting agency by lenders who have extended credit to you. Much of it is used to calculate your FICO® Scores to inform future lenders about your creditworthiness. Although each of the credit bureaus—Experian, Equifax.

What to look for when you review your credit report. When you review your credit reports, look for changes to your personal information. This includes account. Your credit report is an important part of your financial life. It can determine whether you can get credit, how good or bad the terms for getting credit. These companies collect information and produce reports on people's credit histories, which they may provide to a lender who is considering advancing credit to. Here is some valuable information about your credit score and your credit report, as well as tips to help you manage them and try to avoid credit fraud. Who can access your Equifax credit report? Read this article to find out which individuals and businesses can legally access your credit information. While potential employers don't have access to your credit score, they might request a modified credit report for insight into your credit history. When you apply for a loan or another form of credit, lenders look at your credit report to decide whether to offer you credit. 8 Types of Companies That Are Looking at Your Credit Report · 1. Credit card companies · 2. Insurance companies · 3. Employers · 4. Telecommunications companies · 5. Your credit report cannot be viewed by anyone who does not have a legitimate need for viewing it. Credit bureaus can provide information only to the following. Get a free copy of your credit report every 12 months from each credit reporting company. Ensure that the information on all of your credit reports is correct. FICO scores are calculated based on five weighted factors: payment history, amounts owed, length of credit history, new accounts, and credit mix. A credit score is a number that's calculated based on the information in your credit report. It helps businesses predict how likely you are to repay a loan and. A credit report shows your loans, credit cards and payment history, as well as whether you've filed for bankruptcy. Your credit history is important to a lot of people: mortgage lenders, banks, utility compa- nies, prospective employers, and more. Your credit report is your financial report card. Since it can affect so many areas of your life, including whether you can qualify for a home or car loan. This is the only authorized online source under federal law that provides free credit reports from the three major national credit reporting companies—. Equifax. And that makes your credit reports critical for decisions about whether to lend you money in the form of credit cards, mortgages, car loans and more. But that's. Your credit report is a detailed account of your credit history, while your credit score is a three-digit number signifying your credit-worthiness. Your credit profile or credit report is an electronic record of your credit activities. Every time you apply for credit, whether it is approved or denied. There are three major credit reporting companies in the United States: Equifax, Experian, and TransUnion. Because your credit score is based on your credit.